Good Q2 growth to spur property market

Marc Townsend of CB Richard Ellis said at a Thursday meeting that HCM City continued to be a key driver for the national economy, which was shown at the 11 per cent year-on-year GDP growth in the second quarter. The industrial and construction sectors even represented a high rate of 11.3 per cent. Meanwhile, retail spending continued to strengthen substantially by 34.6 per cent over the 2009’s second quarter.

Infrastructure projects including East West Highway, Thu Thiem Tunnel and Saigon Bridge 2 will also be drivers to the property market.

According to CBRE, the HCM City office market, across all grades, saw an increase in gross floor area (GFA) of 9.6 per cent during the second quarter thanks to nine new buildings contributing 124,584sq.m. Vincom Centre alone represented almost 76,000sq.m.

With companies unwilling to pre-let speculative developments, the addition of Vincom Centre resulted in a jump in Grade A vacancies to 31.9 per cent. By contrast, Grade B market saw the vacancy rate decrease to 10.3 per cent, despite the addition of two new buildings which provided 25,600sq.m.

Absorption continued to be strong and improved significantly on Q1. The second quarter saw 72,726sq.m of absorption, bringing the total in first half of 2010 to 130,739sq.m, close to the 154,458sq.m absorbed in the whole of 2009.

Given the arrival of Vincom Centre and the promotional rates that were offered to the rental rate for Grade A buildings decreased to US$37.51 per sq.m per month, from $39.60 in the first quarter.

This increase in space and decrease in rental prices was reflected in the Grade B and C office markets which saw rental rate decreases of 7.95 and 3.12 per cent reflectively.

Meanwhile another property service provider Savills Vietnam noted that by the end of 2010, the office market is expected to receive about 20 office buildings with total 153,000sq.m.

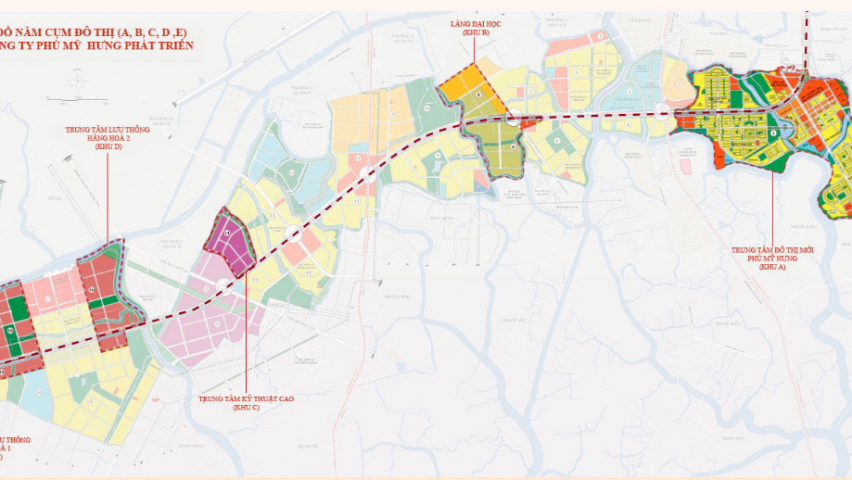

District 1 is still the economic centre of the City, so occupancy accounts for the highest market share at around 49 percent. District 7, especially, Phu My Hung Area, has invested heavily in infrastructure and the population has strongly increased, resulting in an expected 20-per-cent increase of office demand.

Rental rates

Retail rental rates within the central business district hit an all time high of $120.90, increasing from $100.50 in the first quarter.

Vincom Centre added 58,000 sq.m or an additional 39.5 per cent of retail space to the CBD, giving homes to new retailers to the Vietnamese market including Just Cavalli, Jimmy Choo and BCBG.

Away from the CBD, rental rates showed a decrease in the period under review, decreasing by 3.3 percentage points to $46.2 per sq.m per month. Given the increase seen in the first quarter this shows that there is some fluctuation within the non-CBD market and that ultimately retailers are retaining their preference for CBD locations.

According to Savills, Q2 recorded four new retail centres: Vincom Centre Shopping Mall, Lotte Mart Phu Tho, Maximark Ba Thang Hai, and Co-opmart Phu Tho, with around 113,000sq.m.

At present, there are six department stores, 19 shopping centres, six retail podiums, 61 supermarkets and three wholesale markets in the city with a total area of approximately 602,000sq.m.

Occupancy rate this quarter for the whole of the retail market was at 96 per cent, a slight increase of one percent q-o-q.

This year 100,000 square metres of new supply is expected to enter the market while 2012 and onward will be big years as 429,000 square metres of new supply are expected with the completion of some major projects.

Apartments for sale

Evidence from real estate trading floors and CBRE sales teams suggests that in the quarter under review enquiries for purchases increased by approximately 25 per cent.

The period saw a record 17 projects launched, with the affordable sector accounting for over a half. These projects spread across 12 different districts.

Binh Tan District, Binh Thanh District and District 2 are the top three districts for primary supply with market shares of 14, 14 and 12 per cent respectively, according to Savills.

Meanwhile, there are approximately 49,400 apartments in the city’s secondary market, an increase of 2,160 units compared with Q1 2010. District 7, Binh Thanh and District 2 remained the top three districts in the secondary market by number of units with market shares of 25, 12 and 10 per cent respectively.

Savills said the average price of the whole market this quarter was approximately $1,370 per sq.m, an increase of nearly 40 per cent compared to $980 per sq.m in Q1, with Grade A price increasing 68 per cent mainly due to the launching of new projects with high prices in good locations.